Our strategy

Over the next few years, by leveraging the distinctiveness of its business model (leadership in reference markets, strong reputation, lean organizational structure, client-centricity, ability to attract talent, and excellent asset quality), the CIB Division will strengthen its leadership position by leveraging on the Private & Investment Banking model and exploiting the clear intra-Group potential opportunities (in particular with Private Banking, MA and Arma Partners), confirming its position as partner of choice for medium-sized and large companies in its target markets (Italy, France and Spain).

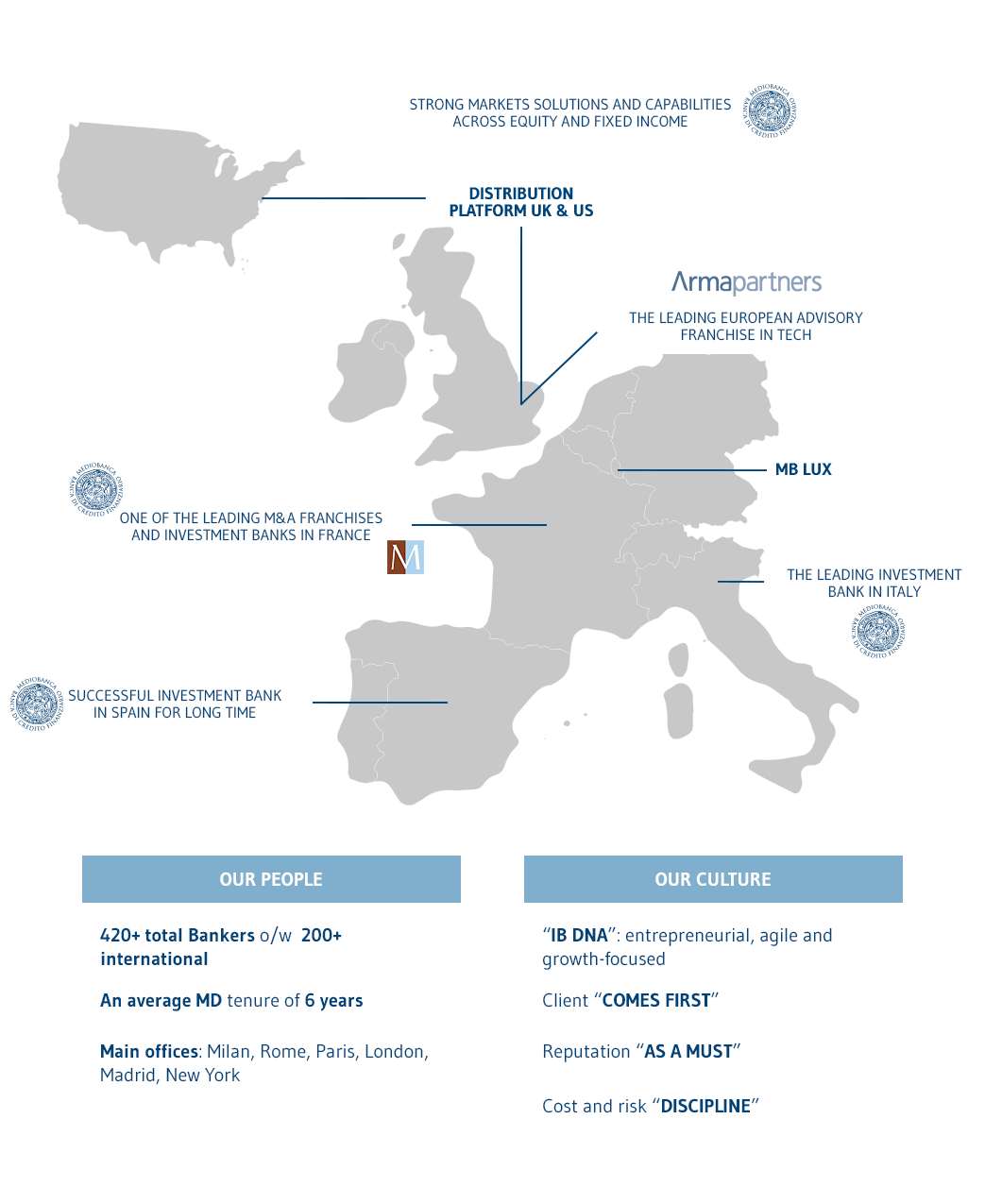

Corporate & Investment Banking activities are carried out by Mediobanca and Messier et Associés (partnership agreement signed in spring 2019). The partnership signed with Arma Partners, European leader in digital economy advisory services, will also become fully operative over the three years of the Plan. MBCredit Solutions and MBFacta complete the range of products offered in credit management and factoring.

The European Corporate & Investment Banking market continues to reflect a challenging competitive scenario, but at the same time offers the following opportunities: it is seeing strong domestic and cross-border M&A activity involving medium-sized firms and large corporates, which are increasingly focused on sector consolidation in order to address the prospects of low organic growth and the need for cost efficiency, and the investment needs of private capital investors who benefit from having significant liquidity. Growth and transformation of new sectors (such as Tech, Energy Transition, and Healthcare) represent an exceptional opportunity for investment banks specializing in advisory business to grow.

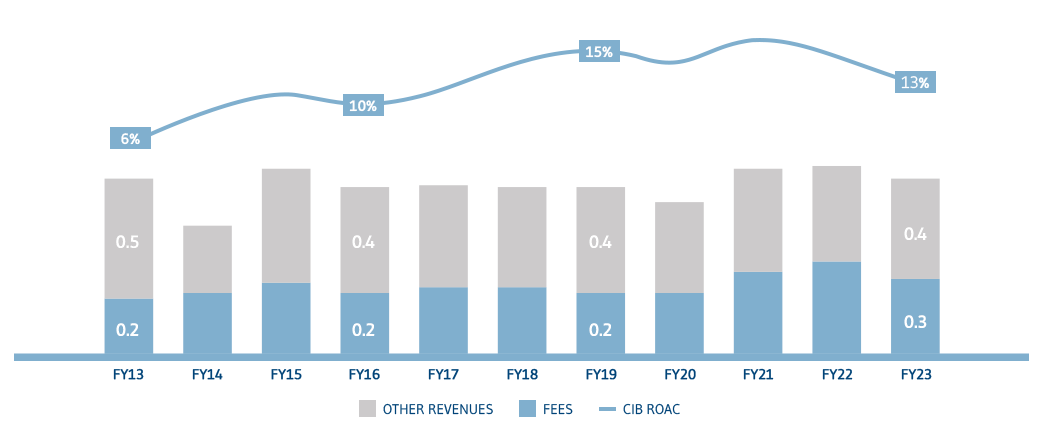

The Mediobanca CIB Division shows strong and resilient profitability (average ROAC in past 4Y 13-14%), and ability to succeed despite headwinds in European investment banking where revenues have contracted in recent years at a CAGR of 15% and the cost/income ratio has risen to 75%, creating the need for significant processes of restructuring, disposals, capital injections and personnel reductions. By contrast, Mediobanca CIB has displayed high levels of resilience in terms of client revenues (stable in recent years at around €630m) and a low risk profile (high asset quality, no litigation, cost/income ratio of 43%). The high resilience shown is due to a distinctive competitive model: the Group’s long-standing position of leadership in Italy is coupled with a strong positioning in Spain and France, a distinctive, client-centred Private & Investment Bank model focused also on SMEs, with high diversification in terms of geography (Italy accounts for 60% of total revenues) and product, with a focus on low capital-absorption products (advisory 32%) and low exposure to more volatile products.

MB CIB has delivered stable results across the cycle in terms of both revenue and profitability on the back of its diversified portfolio of businesses across products, clients and geographies.

In the most difficult years for the IB market MB CIB has outperformed the industry, thus confirming the resiliency of its business model.

| €bn | BP23T | FY23 | Target |

|---|---|---|---|

| Loans | 20 | 20 |  |

| Revenues | 0.7 | 0.7 |  |

| ROAC | 16% | 13% |  |

The division also stands out for its specialist approach founded on advisory business and client-driven, and its strong integration with the Private Banking activities. This has enabled the Group to attract talent, consolidate its leadership position in Italy, and gain increasing visibility in the rest of Europe, primarily in the Spain and France. Going forward, the international footprint will expand as a result of Arma Partners’ leadership position in the Tech advisory segment in the United Kingdom and Northern Europe.

Mediobanca’s ability to take these market opportunities successfully will be driven by further strengthening of its:

CIB franchise, expanding into new geographies, sectors, clients and products. This will be achieved through:

- Reinforcement of industry coverage, with a particular focus on the fastest-growing and most innovative sectors, such as Tech, Energy Transition and Healthcare; in Tech, the partnership signed with Arma Partners will enable the Group to develop a primary European digital economy platform;

- Expansion of the client base, expanding private capital coverage (to ensure a holistic, pan-European approach to private equity, infrastructure, pension and sovereign funds), building an international Mid-Caps platform across both countries already covered (France and Spain) and new ones such as Germany and the United Kingdom;

- Development of new products, developing CO2 trading, aiming at becoming a BTP specialist, becoming registered as US securities-based-swap dealer, and expanding the certificates business internationally.

Distinctive positioning as Private & Investment Bank, based on development of the “One Franchise” between CIB and WM. The possibility, which only Mediobanca offers, of serving both entrepreneurs (WM) and their businesses (CIB) at the same time, is a differentiating feature in Italy, where the backbone of the capitalist system is primarily made up of excellent medium-sized enterprises, often family-run or owned;

Specialty Finance activities: factoring (MBFacta) and credit management (MBCS), the latter being stripped back to its original mission of third-party NPL management (after an agreement was reached to dispose of the NPL acquisition business);

Different approach to capital management: special attention will be focused on developing capital-light activities (Advisory, ECM, DCM), volume growth (loans and market) exclusively from a risk-adjusted return on capital perspective, and on implementing optimization actions. Over the Plan’s 3Y time horizon, the capital allocated to the CIB Division is also expected to reduce to no more than 1/3 of the Group’s total capital (vs 50% in 2016); customer loans are expected to remain stable (at €20bn), while RWAs should reduce (by 4% in 3Y to €17bn) due to the optimization actions.

By the 2026 time horizon we see:

- Solid revenue growth (CAGR: +8%) to €0.9bn, becoming more visible and diversified in terms of both geographies (non-domestic revenues to increase from 40% to 55% of the total) and products, with the contribution from Advisory business expected to rise to two-thirds of total fee income driven by low capital-absorption activities;

- Cost/income under control (49%);

- Selective production in lending reverting in stable loans (€20bn);

- Decrease in capital absorption with RWA down to €17bn (CAGR: -4%);

- Increasing profitability (RORWA at 1,6%).