Acquisitions and disposals

Over the last few years, we have changed our strategy, reducing equity investments to ensure we have resources for M&A transactions in our business sectors

The transformation of our business model, evolved from a holding company to a specialised financial player, can now be considered complete. This process started in 2013 and was completed during the 2016-2019 three-year plan: we sold the remaining holdings in our investment portfolio, with the exception of the 13% stake in Assicurazioni Generali, that today represents the Insurance division’s main asset .

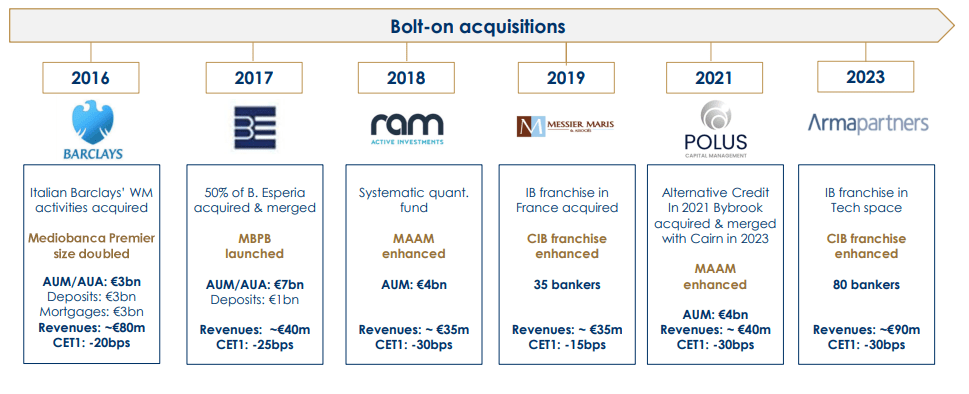

The acquisitions strategy launched in June 2013 with the approval of the 2014-2016 plan represented a genuine strategic turning point, since Mediobanca has previously favoured internal growth. We focused our growth strategy in the Wealth Management division, which has been our priority since 2016, by acquiring the remaining 50% of Banca Esperia, the Italian retail activities of Barclays and specialized asset managers: Cairn Capital (become Polus Capital after merging with Bybrook), Ram AI and Bybrook.

Through M&A we also strengthened our Corporate & Investment Banking division. We expanded our presence in France with the acquisition of the French boutique Messier et Associés in April 2019 and in the Digital Economy sector with the strategic agreement signed with Arma Partners LLP in May 2023.

The strong capital position allows us to maintain a buffer of approx. 100 bps for possible M&A opportunities to support the Group’s business development, calculated on a minimum CET1 FL level of 13.5%. Moreover, the 13% stake in Assicurazioni Generali represents an additional source of capital for external growth. Over the next 2023-2026 plan, we intend to continue our expansion also through targeted acquisitions of companies that can accelerate our growth in core activities, with a preference for businesses with low capital intensity and high commissions. When choosing potential target companies, we also consider cultural compatibility and the ethical business approach. The acquisitions respect the value creation criteria the group has always employed.

| DATE | ACQUISITION | DISPOSAL |

|---|---|---|

| 3RD QUARTER OF 2022-2023 | COMPASS EXPANDS IN SWITZERLAND BY ACQUIRING 100% OF HEIDIPAY SWITZERLAND AG | |

| 3RD QUARTER OF 2022-2023 | MEDIOBANCA FURTHER DEVELOPS ITS ADVISORY BUSINESS THROUGH STRATEGIC INVESTMENT IN ARMA PARTNERS | |

| 3RD QUARTER OF 2020-2021 |

CAIRN CAPITAL TO ACQUIRE BYBROOK CAPITAL, MEDIOBANCA RETAINS ITS MAJORITY STAKE |

|

| 3RD QUARTER OF 2018-2019 | MEDIOBANCA AND MESSIER MARIS TIGHTEN LONG-TERM STRATEGIC PARTNERSHIP | |

| 2ND QUARTER OF 2017-2018 | 69% STAKE IN RAM ACQUIRED. | |

| 1ST QUARTER OF 2017-2018 | SALE OF EQUITY INVESTMENT IN ATLANTIA | |

| 4TH QUARTER OF 2016-2017 | SALE OF 2.7% OF ITALMOBILIARE | |

| 3RD QUARTER OF 2016-2017 | SALE OF 5.1% OF KOENIG & BAUER | |

| 1ST QUARTER OF 2016-2017 | FULL CONTROL OF BANCA ESPERIA ACQUIRED | |

| 1ST QUARTER OF 2016-2017 | SPAFID, MEDIOBANCA GROUP COMPANY, ACQUIRES FIDER SRL, AN IMPORTANT MILAN TRUST COMPANY | |

| 1ST QUARTER OF 2016-2017 | SALE OF 1.3% OF ATLANTIA | |

| 2ND QUARTER OF 2015-2016 | ACQUISITION OF PERIMETER OF RETAIL ACTIVITIES OF BARCLAYS IN ITALY THROUGH CHEBANCA! | |

| 2ND QUARTER OF 2015-2016 | SALE OF 3 MILLION IN SHARES OF ASSICURAZIONI GENERALI (EQUAL TO 0.22% OF THE SHARE CAPITAL) | |

| 2ND QUARTER OF 2015-2016 | SALE OF EQUITY INVESTMENT (5.1%) IN EDIPOWER | |

| 1ST QUARTER OF 2015-2016 |

SALE OF EQUITY INVESTMENT IN PIRELLI THROUGH THE TAKE-OVER BID TO THE OPA CARRIED OUT BY MARCO POLO INDUSTRIAL HOLDING |

|

| 5 AUGUST 2015 | ACQUISITION OF CONTROL OF CAIRN CAPITAL GROUP LTD, ASSET MANAGEMENT AND ADVISORY COMPANY WITH REGISTERED OFFICE IN LONDON SPECIALISED IN CREDIT PRODUCTS |