International business

Over the past 15 years, we have expanded our Investment Banking business in Europe, growing from a top merchant bank in Italy to a leader in Southern Europe. We are also exploring international expansion opportunities in Consumer Finance and our Wealth Management division’s specialized boutiques

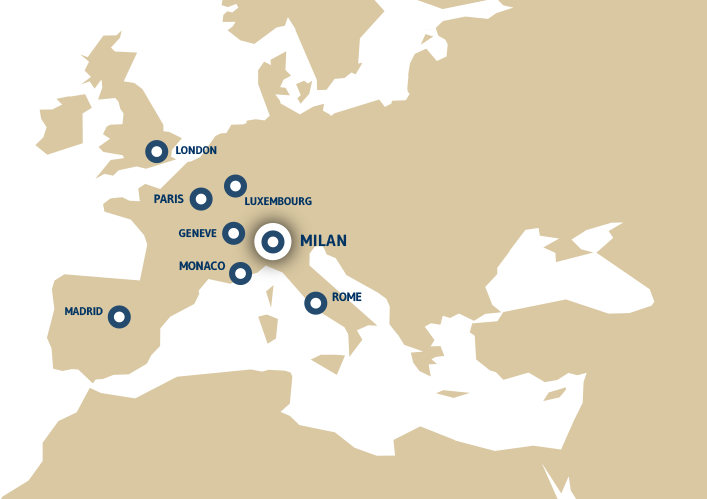

Our international strategy features:

- synergies between sectors, products and countries, with branches and offices in Paris, New York, Madrid and London;

- leadership in the Southern European investment banking sector, which we have achieved by developing the Madrid branch (we are one of Spain’s top ten M&A players) and through our partnership with Messier & Associés, which has significantly improved our position in France (see the box below);

- a growing footprint in the Digital Economy sector through a partnership with Arma Partners;

- a lean structure (approx. 200 professionals, equal to 50% of all wholesale banking personnel) with a contained cost/revenue ratio;

- a hub in London for international investment banking customers and operations.

The partnerships with Messier & Associés and Arma Partners expands our European footprint

In 2023 Mediobanca signed a strategic agreement with Arma Partners, a London-based financial advisory firm leader in the Digital Economy. Arma Partners has approx. 80 bankers and an international client base.

In 2019, we signed a long-term strategic partnership with Messier & Associés (MA), acquiring a 66% stake in the firm. MA is now one of France’s top three corporate finance boutiques, with an extensive base of loyal clients in France and abroad. With some 40 professionals, MA specialises in M&A advisory services for medium and large companies and deals with financial sponsors.

With this acquisition, our Group gains a prestigious presence in a country that was already a key market for the CIB division given the importance of French transactions with Italy.

Our Wealth Management division mainly focuses on affluent and private banking customers in Italy, although it has a stable presence in the Principality of Monaco through the subsidiary CMB. However, we have acquired specialized asset management boutiques abroad (Polus Capital in London and RAM in Geneva) and we continue to consider specific transactions irrespective of their geographical location, as long as they are consistent with the growth strategy for Mediobanca Group’s alternative segment.