Our strategy

The Italian savings market is one of the largest in Europe, and as such offers attractive opportunities to realize Mediobanca’s ambition of establishing itself as a leader in this segment, standing out for its quality, responsibility, innovativeness, and the value of its product offering for Premier and Private clients, and entrepreneurs

The Italian wealth management market is one of the largest in Europe, and offers appealing growth potential and opportunities for an operator such as Mediobanca, for the following reasons:

- The market is substantial, growing and still largely “un-managed”: approx. €5tn of financial wealth concentrated in the Affluent (75%) and HNWI segments, with growth rates that are higher than the average rates of growth in domestic GDP; only 35% are AUM/AUA;

- It is undergoing a process of transformation, with the market shares of specialist and mixed operators (banks with dedicated commercial networks) growing at the global banks’ expense;

- There is a growing need on the part of investors for financial protection and planning, as well as the search for alternative yields, in particular by more sophisticated clients who are looking for portfolio diversification, a trend that is accentuated by high inflation. This leads to an industry-wide polarization in terms of demand/supply in alpha products (including illiquid, alternative, private equity) or passive products, which in turn leads to difficulties for non-specialist operators;

- There has been a contraction in margins due to regulation (transparency and consumer protection), competition, and the contraction of performance fees;

- Digitalization appears to be essential to the product offering and for service users (remote channels and artificial intelligence) in view inter alia of the major generational wealth transfer set to take place in the coming years.

.

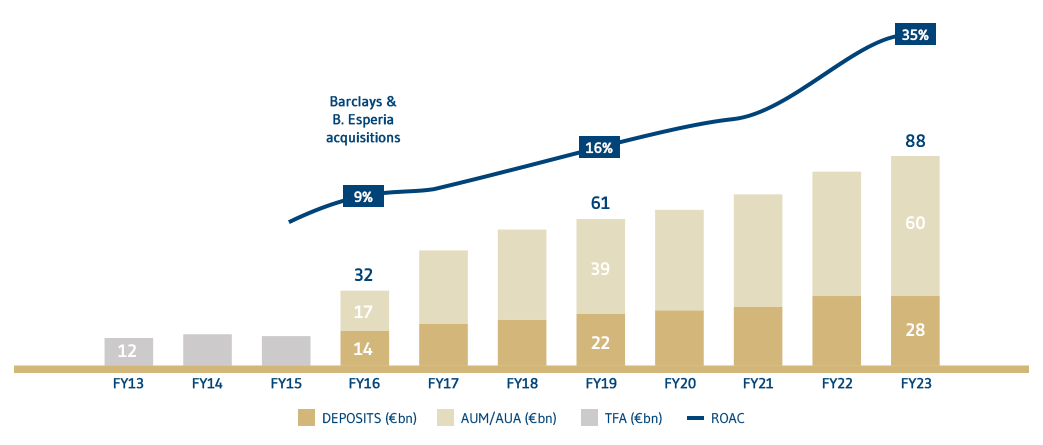

Since 2016, the year when growth in the WM became a priority for the Mediobanca Group, the Wealth Management division has increased by 3x in size, in terms of TFAs (>€85bn1), salesforce (1,200 professionals1), revenues (~€800m1) and profits (~€160m1).

1) FY23E figures: pre-closing data based on accounts, reporting and estimates available on 23 May 2023

The Wealth Management division has met all its BP19-23 targets in terms of volumes, revenues and profitability. The minor delay in meeting distribution network target was due to slowdown in recruitment during the first Covid-19 lockdown.

| KPI €bn | BP23T | FY23 | Target |

|---|---|---|---|

| TFAs | 83 | 88 |  |

| AUM/AUA | 59 | 60 |  |

| Revenues | 0.7 | 0.8 |  |

| Gross fee margin | 0.90% | 0.90% |  |

| Salesforce (#) | 1.4K | 1.2K |  |

| Cost/income | 70% | 68% |  |

| ROAC | 25% | 35% |  |

Under this Plan, Mediobanca’s ambition is to establish itself as the leading wealth manager, distinctive for its quality, responsibility, innovation, and value of the offering dedicated to Premier and Private clients and for entrepreneurs. There will be a radical change of approach in Wealth Management, creating an operator with characteristics that are unique in Italy: Mediobanca’s strengths (brand, culture, product offering, ability to attract bankers) will be applied consistently across the whole customer segment, generating strong growth and value.

Mediobanca Wealth Management will scale up with a fully-fledged platform in terms of core clients (UHNWI to Affluent), asset classes (liquid & illiquid) and dedicated service model (bespoke PIB & inhouse AM capabilities) with a significant upgrade in terms of size, profitability and efficiency, which will allow to close the gap versus other leading asset gatherers in terms of size and profitability.

ONE BRAND -ONE CULTURE: Establish a single, unique Mediobanca brand and culture through the whole client segment/product offering

The Mediobanca Brand is associated with core values (Trust, Solidity, Membership) with a specific “angle” to business (indepth knowledge of complex deals, tailor-made approach) and consolidated customer base (entrepreneurial families). For these reasons, the Brand is well known by all market professionals and it is a powerful catalyst to attract high-end/high-quality Private Bankers and Financial Advisors.

The Group for the next three years will move further in deploying “the Mediobanca Brand & Culture” to:

- maximize the Private – Investment Banking coverage potential with strong attraction of specialized bankers;

- leverage on the “Mediobanca Academy”: replicate the CIB concept of a “school of banking” by conveying our ethics, competence, vision & values to increase sense of belonging and create a distinctive, visible brand culture;

- strongly reposition CheBanca!, including through rebranding as “Mediobanca Premier” (January 2024) and adoption of the Private Investment Banking model.

Investments in distribution and repositioning versus higher end clients

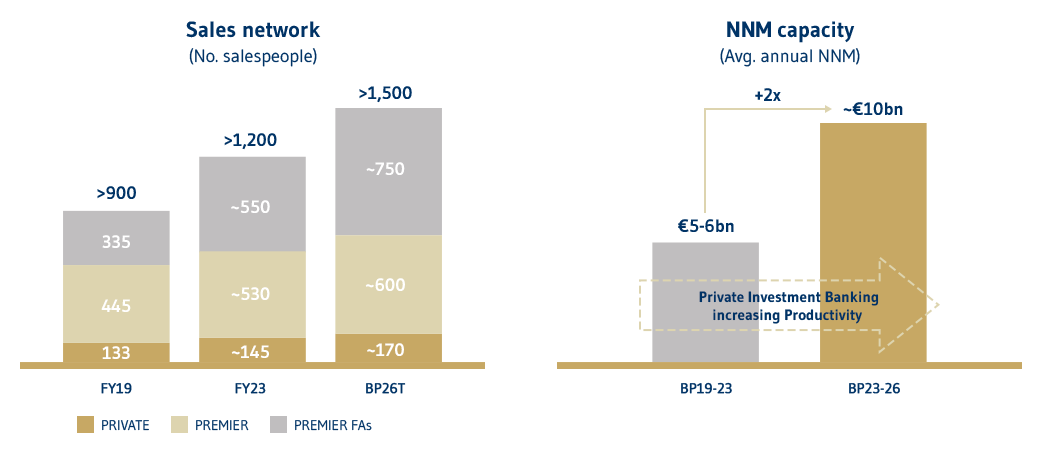

Through substantial investments in distribution (with the salesforce to increase by 25% to over 1,500 professionals), technology and products, WM will be able to generate an average of approx. €10bn in NNM per annum.

The distinctive feature here will be the ability to capture liquidity events deriving from Mediobanca’s solid relations with the over 1,300 medium-sized enterprises which form part of the most dynamic Italian industrial districts, often managed or owned by the entrepreneurial families that make up the backbone of the Italian economy. Thanks to extensive and synergistic coverage of these relationships by private and investment bankers, plus the availability of both Corporate and Wealth Management products, Mediobanca will continue to position itself as partner of choice for these clients, strengthening both its WM and CIB operations.

The new plan envisages a repositioning towards high-end clients also through an upgrade to the service model. Gross marginality will be resilient around 90bps as the service upgrade, the internalization of margins through the “inhouse guided architecture”, plus a change in asset allocation will offset the pressure on margins deriving from possible stricter regulations and the ongoing repositioning vs Premier/UHNWI clients.

Wealth Management will deliver growth at both top- and bottom-line levels to become the second largest contributor to the Group’s revenues and the top contributor in terms of fee income. Profitability will increase significantly, while maintaining high-quality and sustainable revenues and improving efficiency.

Highlights are as follows:

- TFAs will grow by 9% (CAGR) to €115bn, with a strong improvement in composition (AUM/AUA up 12% CAGR to €85bn, rising to 75% of TFAs);

- Gross marginality will remain at around 90 bps;

- Revenues will grow by 9% (CAGR) to over €1.0bn;

- Cost/income ratio will decrease by 8pp to 60%;

- Profitability will increase with RORWA up from 3.1% to 4%.