Our strategy

Over the next few years, the Consumer Finance division, empowering distribution significantly, direct and digital, and developing innovative products (in e-commerce and BNPL especially) will upgrade leadership in Italy in terms of service model (multichannel) by accessing to new clients segments and markets through digital proposition. Compass will increase revenues to €1.3bn, maintaining high profitability (RORWA 2.9%) confirming its position as the Group’s main source of revenues.

Compass has been operating in consumer credit since 1960. For more than fifteen years it has been one of the top three Italian domestic operators, with a leadership position in the most profitable segments (personal loans and special purpose loans). It has a well-established client base (almost 3 million active customers, with more than 14 million in its database), broad and diversified distribution (310 branches – including 130 agencies – plus 175 professionals providing out of branch services, an effective digital platform, third-party bank branches, post offices, credit broker networks, plus numerous agreements in the automotive, telecommunications and large retail markets), and a value-driven approach to management (with the capability to analyse and assess risk at the lending stage and monitor it across the entire loan life cycle, regular bad debt disposals, and strong credit recovery capability), making it the most profitable operator on the market.

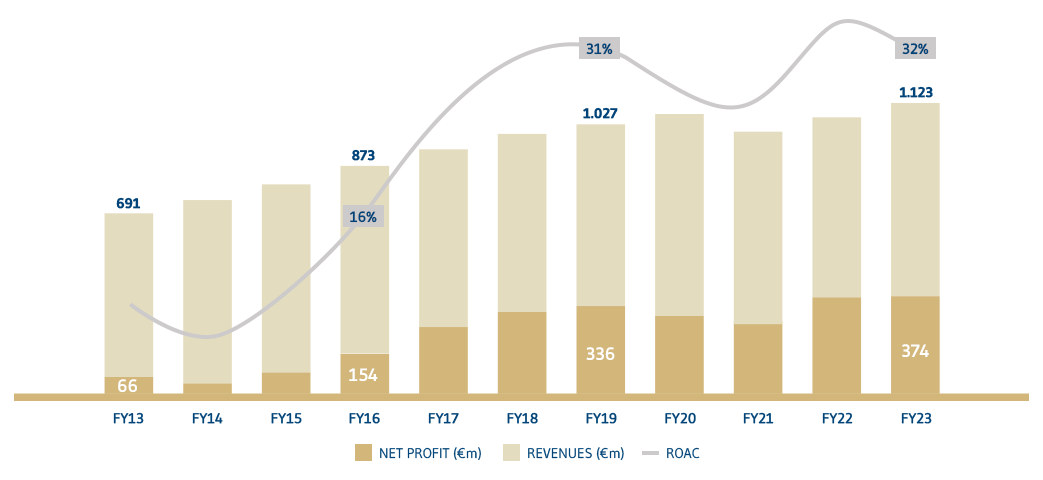

In the 2019-23 four year period, despite the Covid-19 pandemic, the outbreak of the Russia-Ukraine war, high inflation and the sudden rise in interest rates, Compass has reported robust results, confirming its ability to grow profitably in all economic cycles; revenues have remained above €1bn1, net profit has risen to above €370m1, and ROAC is over 30%1; at the same time, the stock of bad loans has decreased further (to 1.3%1 of total loans), while the coverage ratios have increased (to 78%1 for bad loans, and 3.7%1 for performing loans), with substantial overlays preserved. Consumer credit has confirmed its position as the main source of growth for the Group in terms of net interest income, with an anti-cyclical diversification function.

1) FY23E figures: pre-closing data based on accounts, reporting and estimates available on 23 May 2023

Compass has met all its BP19-23 targets in terms of volumes, revenues and profitability

| KPI | BP23T | FY23 | Target |

|---|---|---|---|

| Revenues |

>1.1 |

>1.1 |

|

| ROAC |

28/30% |

32% |  |

| Loans | 14.1 | 14.5 |  |

| New business | 8% | 7,8% |  |

|

PPdirect (%) |

67% | >75% |  |

Despite the reduced penetration of consumer credit in Italy compared to the Northern European economies, modest growth is expected for this market over the next 3Y because of the macro scenario (CAGR +3.8%). Nonetheless, Compass will continue its growth trajectory with the objective of consolidating its leadership in the domestic Italian market, aiming to become increasingly independent from third-party networks for strategic reasons. The 2023-26 Strategic Plan makes provision for substantial enhancement of the local distribution network, significant investments in technology to develop the best digital lending platform, creation of an integrated solution between physical and digital channels, development of innovative products (for e-commerce especially), and growing investments in marketing. All these actions will serve to perpetuate Compass’s leadership in consumer credit services, access new markets and client clusters, and so speed up growth of volumes and revenues, while consolidating earnings and profitability.

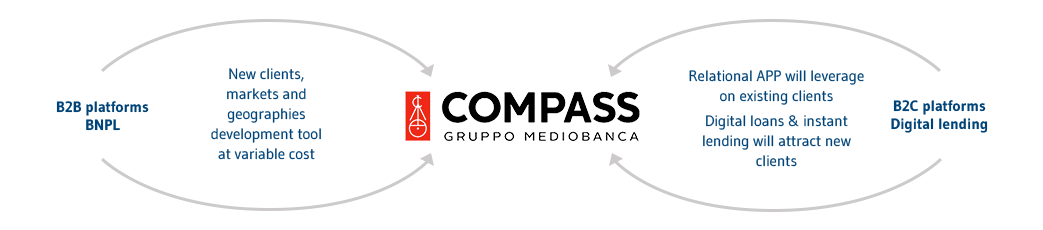

The direct network and the digital channel will be integrated in order to create an efficient multichannel platform, to further improve customer experience and increase lending volumes.

The existing web platform, which is already “mobile native”, generates over 30% of personal loans distributed via the direct channel, and will integrate the most advanced solutions to improve client operations, right from on-boarding. The adoption of sophisticated artificial intelligence engines, combined with Compass’s consolidated experience in credit risk assessment, will allow the volumes of digital personal loans to increase even further and instant lending solutions to be launched for top clients

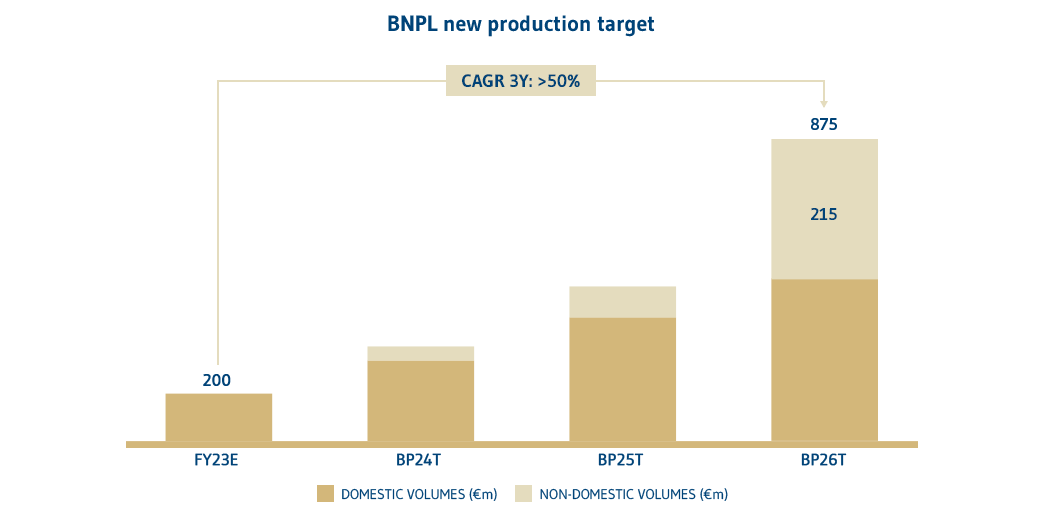

The growth will also be driven by the development of the Pagolight product, Compass’s proprietary Buy Now Pay Later (“BNPL”) solution. BNPL, which started out as a fintech product (lower amounts paid in three instalments, with costs payable by the merchant), is now being offered by Compass via a solution which has made it into a profitable credit product which is generating increasing volumes on the domestic market; for Compass the product – which has already been developed in accordance with EU regulations meaning it should be included within the consumer credit scope of operations – is already showing net profitability (net of direct costs and cost of risk) comparable to that of special-purpose loans; BNPL has also demonstrated it is a powerful instrument for acquiring new customers to whom other products can be offered such as personal loans.

BNPL will allow Compass to expand its client base and to enter new geographies, using high-tech rather than physical solutions. The profitability of the product will be guaranteed by Compass’s proven pricing/risk management capabilities based first and foremost on the use of proprietary statistical and behavioural models developed in over sixty years of business in a wide variety of macroeconomic settings.

The financial targets in the 2023-2026 plan

The actions described above, coupled with the proven effectiveness of the company’s pricing system and credit management and recovery capabilities, will result in:

- increase in new production to €9.3 billion, with a CAGR of 4% and a substantial increase in directly distributed personal loans, which will account for 85% by 2023;

- boost revenue to €1.3 billion, with a CAGR of 4%;

- cost of risk at 160-170bps;

- increase lending to €16 billion, with a CAGR of 4%;

- maintain steadily strong profitability, with a RORWA at 2.9%.