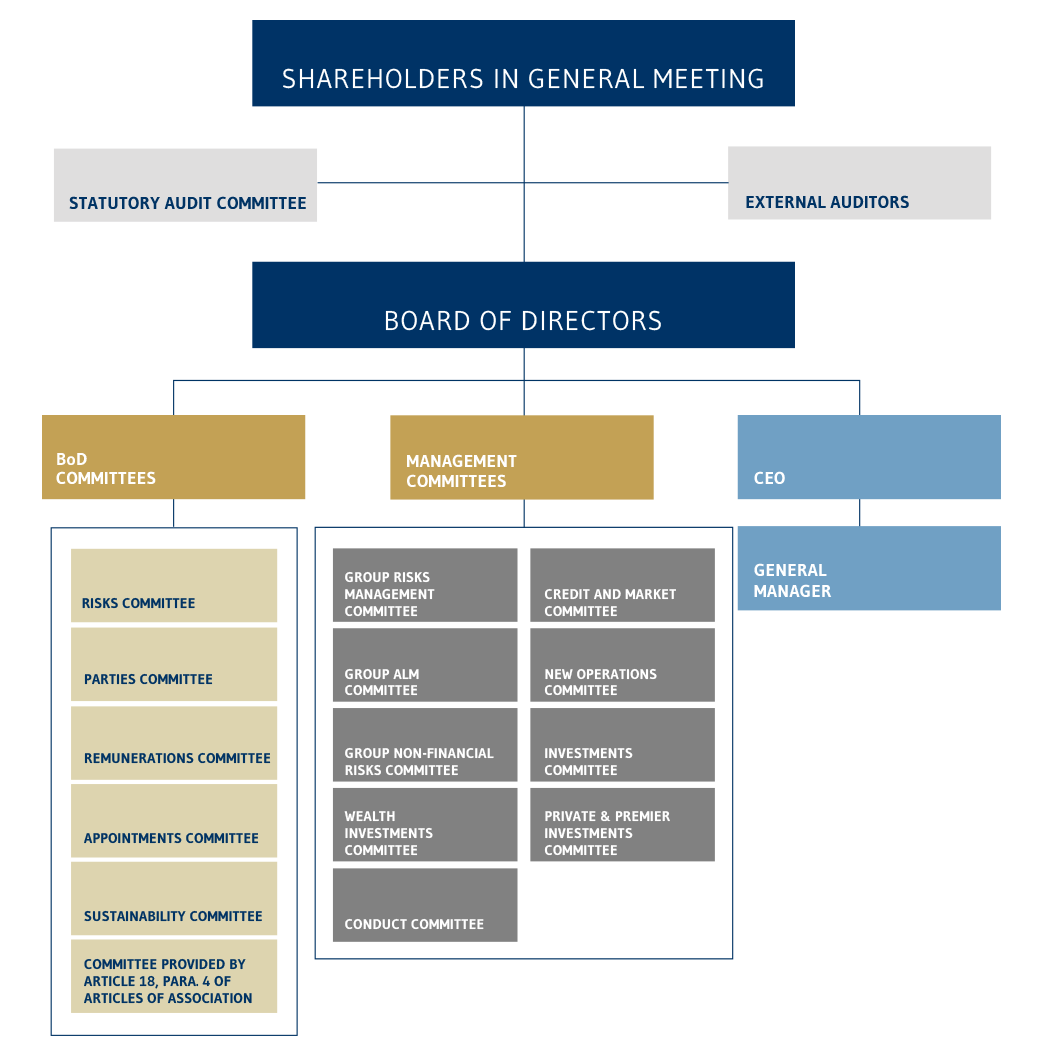

Our corporate governance model

We have adopted a traditional governance model that clearly establishes roles and responsibilities. Our commitment to continuous improvement has led us to embrace innovation in the pursuit of increasingly efficient operations and effective controls

Clear roles and responsibilities

We have adopted a traditional governance model that clearly establishes the roles and responsibilities of the governing bodies to protect shareholder interests while ensuring management benefits from the best operating conditions.

- The Board of Directors is responsible for strategic oversight. Appointed by the shareholders, the board resolves on the bank’s strategic guidelines and monitors their implementation, approves the acquisition and sale of significant investments.

- The Leading Independent Director is responsible for co-ordinating independent Directors’ requests and considerations.

- The Chief Executive Officer is responsible for business management and the implementation of the strategic guidelines.

- Appointed by the shareholders, the Board of Statutory Auditors, is responsible for controls.

In accordance with the recommendations in the Code of Conduct and the requirements of the Bank of Italy, we have set up six board committees: Risks, Related Parties Committee, Remuneration, Appointments and Sustainability Committee and Committee pursuant to article 18, paragraph 4 of the Articles of Association.

Fifteen years ago, our group started a transformation process, and has progressively evolved from a holding company to a specialized financial group. Our business model has evolved alongside the changes in our ownership structure.

In recent years, we have strived to simplify, strengthen and improve our governance, embracing international best practices, not merely to comply with stringent regulations and the requirements of the Code of Conduct, but also to fully satisfy the expectations of the increasingly numerous institutional investors among our shareholders.

This improvement process has driven the Board of Directors to evolve. Today, our board is leaner and highly independent with more gender diversity and members elected from minority lists, and a Lead Independent Director improving the Board’s efficiency, and fostering the relationship between shareholders and the BoD.

Given the growing importance of non-financial factors (ESG) in the business world, in 2019 we set up a Board Committee specifically devoted to Sustainability reinforcing the already in place at management level.

To support the Executive Committee in ordinary operations, we have set up steering committees staffed with group managers and dedicated to specific technical issues and business aspects (see the chart above).

In addition to the committees required by regulations, the Board of Directors has also set up a specific committee for the appointment of the governing bodies at the general meetings of the group’s investees in which the Mediobanca group holds an interest of at least 10% and the interest is worth more than 5% of the group’s consolidated supervisory capital.

Independent Auditors

EY S.p.A has been appointed to audit the accounts for the 2022-30 period.

Davide Lisi is the director of audit.