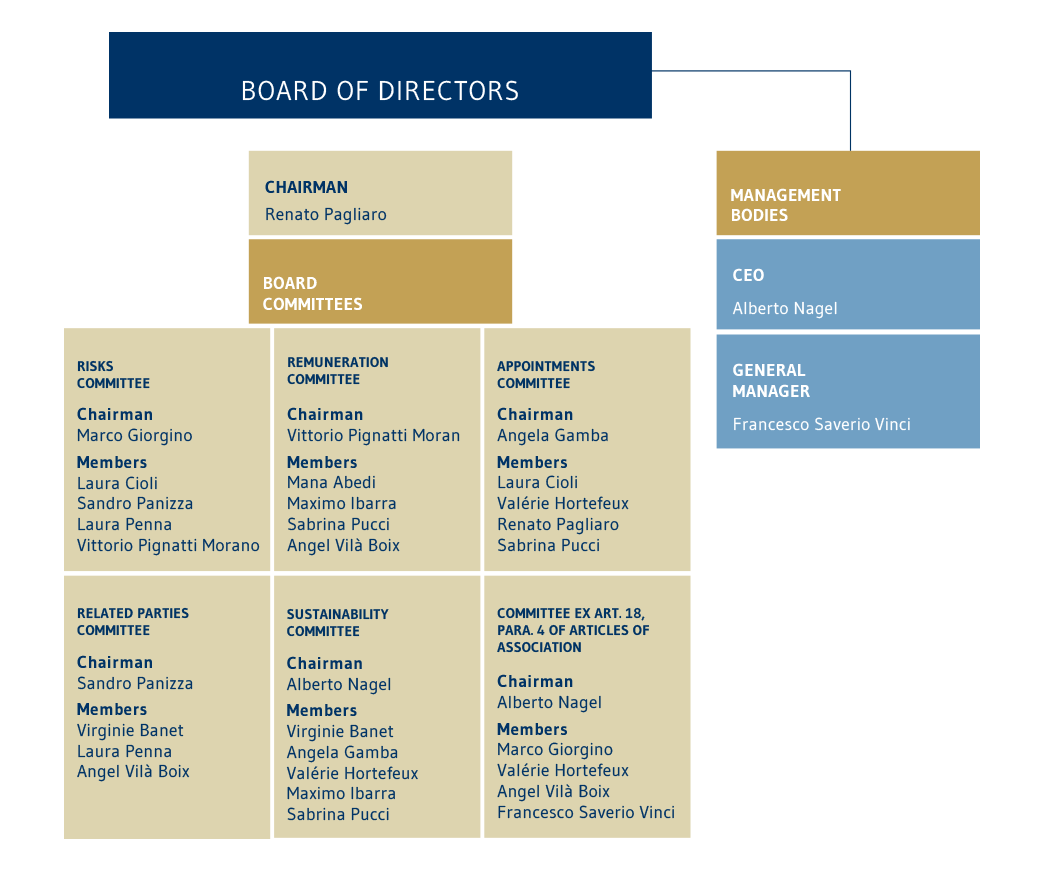

Committees

We have set up six Board Committees: Risks, Related Parties, Remuneration, Appointments, Sustainability Committee and "pursuant to article 18, paragraph 4 of the Articles of Association"

The six Board Committees were set up in accordance with the recommendations in the Code of Conduct and the requirements established by the Bank of Italy on corporate governance. They mainly serve advisory and consultation functions.

| Risk Committee 100% independent member |

The Risk Committee reports to the Board on risk management (including ESG risk assessment and monitoring), the internal control system, and the accounting and financial reporting structure. |

| Related Parties Committee 100% independent member |

The Related Parties Committee has the following duties: to express binding opinions on the adoption of, and potential amendments to, the related parties procedure; and to express its reasoned opinion on the Bank’s interest in executing transactions with related parties. |

| Remuneration Committee 100% independent member |

The Remuneration Committee performs advisory and consultation functions on remuneration policies, the calculation of remuneration for senior management positions, the remuneration of employees and incentive and retention plans. |

| Appointments Committee 83% independent member |

The Appointments Committee supports the Board in the appointment of Directors (when new members are co-opted), the outgoing Board’s presentation of the list of directorship candidates, the Board assessment and the drafting of succession plans for senior management positions. |

| Sustainability Committee 83% independent member |

The Sustainability Committee, was established in 2019 and advises the Board on sustainability issues. |

In addition the committees required by regulations and the Code of Conduct, the Board of Directors has established the committee required by article 18, paragraph 4 of the Articles of Association. This specific committee passes resolutions on the appointment of the governing bodies at the general meetings of listed investees in which the group holds an interest of at least 10% and the interest is worth more than 5% of the group’s consolidated supervisory capital.