Relations with our stakeholders

Listening to stakeholders is an important step in building a process of inclusive and balanced development

Constantly engaging in dialogue with our stakeholders allows us to direct our commitment to the most important issues and to construct a shared path which creates value for everyone over time. It is through correct, transparent and responsible conduct that we cultivate long-lasting relations based on trust with our stakeholders.

As a group, we are fully aware that we can play an active role in building a strong and prosperous community, always putting people, the environment and society at the forefront of our operations.

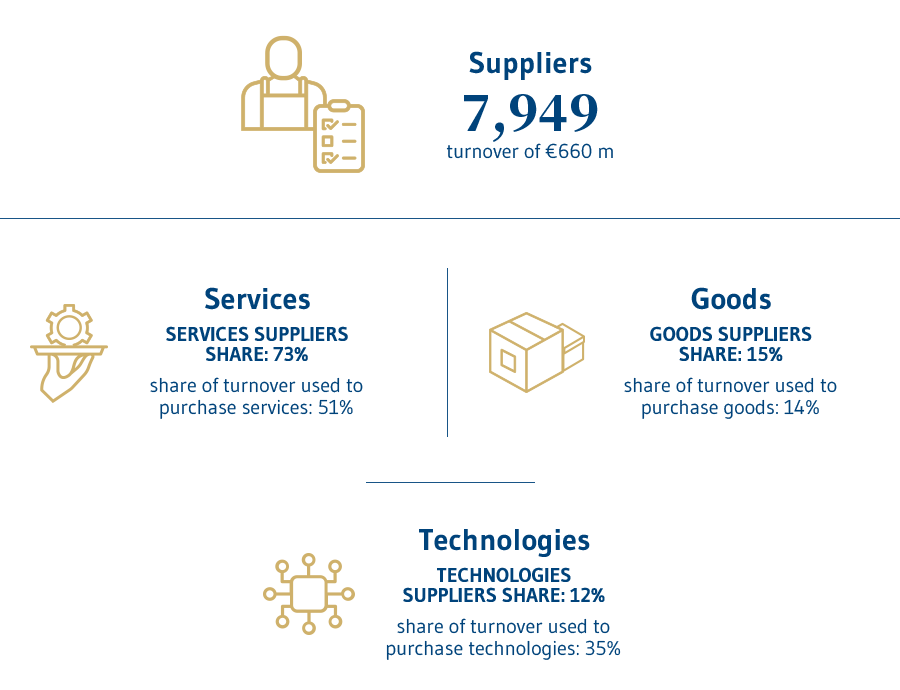

We nurture relations with our suppliers based on correctness, transparency and fair treatment. We select our partners based on criteria relating to professional expertise, capital solidity and economic offer and we require respect for ethical, social and environmental standards in line with our Code of Ethics and the current legislation.

We look on relations with our investors and shareholders as an ethical-strategic responsibility of the company aimed at creating effective two-way communication between the company and the financial community.

Integrity, professionalism, transparency and loyalty are the guiding values in relations with all our customers, whose satisfaction is of paramount importance for us. In order to offer a high-quality service and solutions able to meet everyone’s needs, listening and constant dialogue are key elements. We conduct customer satisfaction surveys to identify the critical areas which need intervention and develop tools which aid an immediate understanding of products and services, so that fully-informed and knowledgeable decisions can be taken.

We enrich our offering with responsible products and services, by promoting a sustainable approach to investments and supporting social and environmental development.

We place huge attention on protecting the personal data and information of customers, ensuring it is protected from unauthorised or accidental modifications, loss or unauthorised disclosure through specific Policies and Directives.

Lastly, we implement financial education and inclusion projects to promote growth in the local area and of the company.

We engage in constructive, continuous and transparent relations with a number of public authorities and institutions, in particular, with the Supervisory Authorities, combatting all forms of corruption. At regional level, this relationship of close synergy and trust has helped us to create cultural, artistic, social and sporting initiatives and events to address the priorities and needs of local communities.

The main group associations and collaborations in terms of financial services include:

- ABI – Associazione Bancaria Italiana (Italian Banking Association), the association that represents Italian banks or those operating in Italy and the majority of financial intermediaries;

- ABI Lab, the Research and Innovation Centre for Banks promoted by ABI for the purpose of creating an environment where banks and ICT and energy partners can meet and engage in dialogue;

- AFME - Association for Financial Markets in Europe, European association of intermediaries operating in wholesale banking;

- ASSOGESTIONI - Associazione italiana dei gestori del risparmio (Italian Association of Asset Managers) representing the majority of Italian and foreign asset management companies operating in our country, in addition to banks and insurance companies active in individual and collective asset management;

- ASSONIME - Associazione fra le Società Italiane per Azioni (Association of Italian joint stock companies), founded in 1910, whose purpose is the study and discussion of problems directly or indirectly concerning the interests and development of the Italian economy;

- ASSOSIM - Associazione Italiana Intermediari dei Mercati Finanziari (Italian Association of Financial Markets Intermediaries), which carries out research and training and participates in consultations promoted by CONSOB and the Bank of Italy on regulatory and financial matters;

- Conciliatore Bancario Finanziario (Banking and Financial Ombudsman), non-profit association specialised in dealing with banking, financial and corporate disputes;

- European Issuers, organisation that represents, at European institutions, the interests of listed public companies of all sectors;

- International Capital Market Association (ICMA): non-profit organization and category association for participants in capital markets;

- ISDA - International Swaps and Derivatives Associations: international organization regulating the derivatives market.

- Net Zero Banking Alliance (NZBA):alliance promoted by the United Nations Environment Programme Finance Initiative (UNEP FI), the UN Programme section devoted to financial institutions, set up with the objective of accelerating the sustainable transition of the international banking sector;

- Principles for Responsible Banking (PRB): aunched by the United Nations in 2019 to support sustainable development by banks, aligning it with the UN 2030 Agenda and Paris Climate Agreement 2015 objectives;

- International Capital Market Association (ICMA): non-profit organization and category association for participants in capital markets;

- Net Zero Banking Alliance (NZBA):alliance promoted by the United Nations Environment Programme Finance Initiative (UNEP FI), the UN Programme section devoted to financial institutions, set up with the objective of accelerating the sustainable transition of the international banking sector;

- Principles for Responsible Banking (PRB): aunched by the United Nations in 2019 to support sustainable development by banks, aligning it with the UN 2030 Agenda and Paris Climate Agreement 2015 objectives;

- Principles for Responsible Investment (PRI) launched by the United Nations in 2006 with the intention of promoting the dissemination of sustainable and responsible investing among institutional investors;

- Task Force on Climate-related Financial Disclosures (TCFD): set up in December 2015 by the Financial Stability Board (FSB) – the international body that monitors the global financial system – the TCFD issues recommendations to develop more effective climate-related disclosures;

- Task Force on Climate-related Financial Disclosures (TCFD): set up in December 2015 by the Financial Stability Board (FSB) – the international body that monitors the global financial system – the TCFD issues recommendations to develop more effective climate-related disclosures;

- United Nations Global Compact, a United Nations initiative created to encourage companies all over the world to adopt sustainable policies and strategies.

In order to grow the group, we strive to develop our people, by strengthening their professional development through adequate training, practical experience, mobility in different positions, performance evaluation and fair process of career progression and promotion, in respect of equal opportunities and the needs of each person. Our commitment, the roles and responsibilities in the development of our personnel are defined in the Human Resources Management Policy, to which we have added internal procedures that regulate some key processes for personnel development and management.

Our choices are based on guaranteeing compatibility between economic initiative and environmental requirements, in respect of the regulations and codes of corporate governance. Our commitment to the protection of the environment is achieved by managing two types of impacts: direct impacts, where we promote responsible management of natural resources and CO2 emissions and indirect impacts, which we regulate thanks to responsible financing and investing and ESG products.