Business model and divisions

Our business model is that of a specialized financial group, with a holistic and synergistic approach between our different businesses, all of which combine to produce a coherent structure.

Our 2023-26 Strategic Plan “One Brand-One Culture” aims to establish Mediobanca definitively as a leader in Wealth Management, leveraging on the synergies generated with our historical Corporate & Investment Banking business. We offer our clients sophisticated solutions, and are able to manage complex, high added value transactions through the efforts of our talented staff and our ethical and responsible approach.

Through the strong synergies generated between the Wealth Management and Corporate & Investment Banking divisions, we have developed a “Private & Investment Banking” model which is unique in Italy and a strong distinguishing feature, making us a bank of choice for businesses and entrepreneurs. Our indepth knowledge of the Italian entrepreneurial fabric, allied with our strong track record in acquisitions and capital markets operations, allow us to offer our clients integrated and sophisticated solutions, both in managing entrepreneurs’ own personal wealth and providing advice to their companies.

The Consumer Finance and Insurance divisions are both highly profitable and resilient businesses, that allow us to diversify our revenues and expand our earnings generation capabilities, helping to ensure our stability over the long term, and enabling us to offset our cyclical businesses (CIB) with anti-cyclical ones (Consumer Finance). The Consumer Finance division also helps to diversify the Group’s sources of funding, by providing direct access to the interbank market, and as one of the leading operators in the ABS segment. The Insurance division also acts as a source of capital for potential M&A transactions.

Our business model has demonstrated stability over time, coupled with the ability to transform market difficulties into opportunities, as shown by the excellent results delivered for the twelve months ended 30 June 2024.

The launch of the Wealth Management division was the change introduced by the 2016-19 strategic plan, and in the space of a few years Mediobanca has established itself as one of the most dynamic and appealing players in the Italian wealth management and private banking markets.

In order to position ourselves definitively as a market leader in this sector, we are focusing on our specific Private & Investment Banking model, our indepth knowledge of the Italian business world, and the high reputation enjoyed by our brand.

We have developed and structured these activities around three divisions:

- Mediobanca Premier: launched in 2024 following the rebranding of CheBanca!, Mediobanca Premier is an important and indeed iconic venture, because it associates the Mediobanca brand with a major repositioning versus Premier segment clients, who are well-suited to both the Mediobanca brand and the kind of products we offer. The successful launch Mediobanca Premier was immediately met with considerable interest which has translated to a significant acceleration in the recruitment of bankers and Financial Advisors with large client portfolios, and to growth in higher bracket customer numbers.

- Mediobanca Private Banking: created following the buyout and merger of Banca Esperia into Mediobanca S.p.A, Mediobanca Private Banking has a unique position in its reference market on the back of its ability to assist entrepreneurial families by leveraging on synergies with investment banking and its capability to structure distinctive products such as Private Markets and Club Deals.

- Asset Management: the “One Brand-One Culture” approach also translates to closer co-operation between distribution and the product factories, which offer a distinctive proprietary offering in terms of commercial proposition.

Wealth Management activities have a highly specialist content, a wide recurring fee base, and low capital absorption levels. They are highly synergic with our traditional investment banking profile, and guarantee a stable source of revenues as well as high profitability.

Through the Corporate & Investment Banking division, which is our historical core business, today we are the leading investment bank in Italy and a recognized operator at European level (with a leadership position in Southern Europe, and an increasingly consolidated franchise in France, Spain, the United Kingdom and Germany).

We always prioritize our clients’ interests, offering them advisory services of the highest standards allied with a full credit product offering, with an acknowledged capability in terms of structuring complex deals and offering sophisticated solutions. We stand out for our indepth knowledge of the Italian business world and entrepreneurs, the excellence of our tailor-made services, our impeccable reputation, our reliability and confidentiality, and our ability to attract and retain highly talented staff.

The division’s growth is based on:

- Increasing synergies with the Wealth Management area. Mediobanca has the capability, which is unique in Italy, to serve both entrepreneur and company at the same time, a major advantage in a country where the backbone of the capitalist system is made up primarily of family-owned medium-sized enterprises.

- International expansion. In the twelve months ended 30 June 2024, the share of revenues generated from non-domestic business contributed 55% of the CIB division’s revenues (40% higher than in the previous year), following the acquisition of Arma Partners, a UK-based company specializing in financial advisory services in the Digital Economy sector, with a geographically diversified client base. In addition to our established presence in France and Spain, in 2024 we opened a branch office in Frankfurt, focused on the mid-cap segment in particular.

CIB is a profitable business, with a wide fee base and diversified activities by source, product and geography.

Our subsidiary Compass Banca, one of the pioneers of the Italian consumer credit industry, has 70 years of experience. With its indepth knowledge of the market, it is now the third largest sector operator in Italy, and a leader in this country in the distribution of products via digital channels.

We are increasingly integrating our direct network with our digital channels to produce an efficient multichannel platform which is able to improve our customers’ experience while increasing our lending volumes at the same time.

This market offers significant opportunities for growth, and we intend to continue making progress in this area, helped by our distinctive features, such as our high scoring and pricing capabilities and our excellent asset quality.

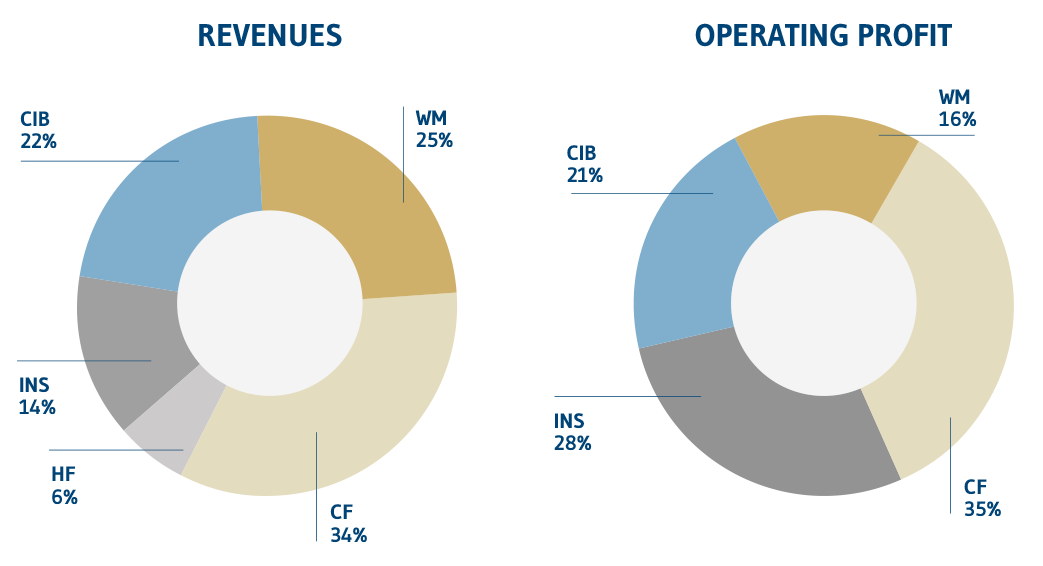

Consumer Finance, a specialist and highly profitable business with high entry barriers, is the leading contributor to the Mediobanca Groups revenues and operating profit.

Our 13% stake in Assicurazioni Generali is an investment that delivers a strongly positive return. It helps to stabilize revenues and earnings, partly because it is decoupled from our banking businesses. It also acts as a value option, ensuring we have available resources in the event of possible future acquisitions.