The Mediobanca Group today

We are among the best European banks in terms of growth in revenues, profitability, remuneration of shareholders and market performance

Mediobanca is a specialised financial group, whose business model is based on synergic, high profit margin and low capital intensity business sectors and in which the group boasts a solid competitive position.

- Since 2016, we have cemented our position in the Italian Wealth Management market, which offers significant long-term growth opportunities. We serve Affluent customers with Mediobanca Premier and HNWI and UHNWI customers with Mediobanca Private Banking and Compagnie Monégasque de Banque.

- In Corporate & Investment Banking activities, in which our roots lie, we hold a position of undisputed leader in Italy. We offer companies high-quality Advisory, Lending, Capital Market and Specialty Finance solutions. We have also established a consolidated presence abroad, in Spain and France in particular.

- Since our foundation, we have been present in the Consumer Finance market, where our subsidiary Compass Banca is one of the three main operators in Italy.

The 2023-2026 business plan forecasts further growth of the group and in the returns for all stakeholders, thanks to the effective and unique business model, albeit in a macroeconomic scenario that is expected to be challenging for the whole financial sector.

Highlights (annual consolidated results at 30 June 2023)

The Group delivered solid results in FY 2022-23:

- Revenues +16% to an all-time high of €3.3bn, driven by business diversification

- Cost/income ratio down to 43%; cost of risk at 52 bps;

- Net profit €1,027m (+13% YoY);

- ROTE1 13%;

- DPS at €0.85 (+13% YoY), equivalent to 70% cash payout;

- ESG: targets delivered, pathways improved.

| PROFIT AND LOSS ACCOUNT | PROFIT AND LOSS ACCOUNT Value | BALANCE SHEET | BALANCE SHEET Value | OTHER INFORMATION | OTHER INFORMATION Value |

|---|---|---|---|---|---|

| Revenues: | € 3.3 bn | Total assets: | € 91.6 bn | S&P rating | BBB |

| GOP risk adj: | € 1.6bn | Customer loans: | € 52.5 bn | Fitch Rating | BBB- |

| Net profit: | €1,027 mln | Funding: | € 61 bn | Moody's | Baa1 |

| Cost/ income ratio | 43% | Lending/funding: | 87 % | Payout | 70% |

| Cost of risk | 52 bps | TFA | € 88 bn | Capitalisation: | € 9.3 bn |

| ROTE | 12.7% | CETI | 15.9% | No. of staff: | 5227 |

1) ROTE calculated using adjusted net profit (GOP net of loan loss provisions, minority interest and taxes, with taxation normalized at 33%, 25% for PB and AM, 4.16% for INS).

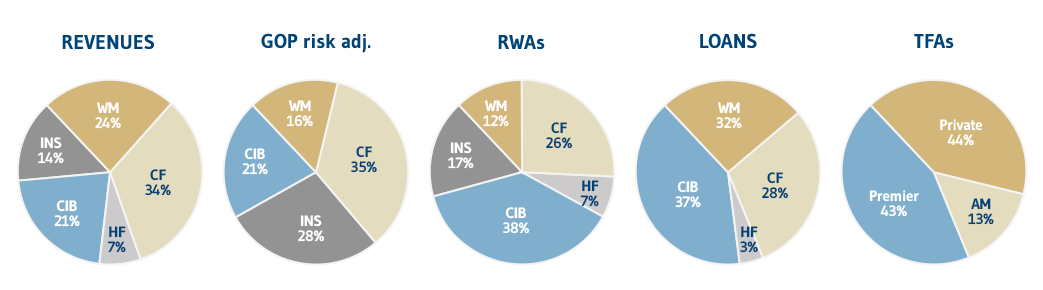

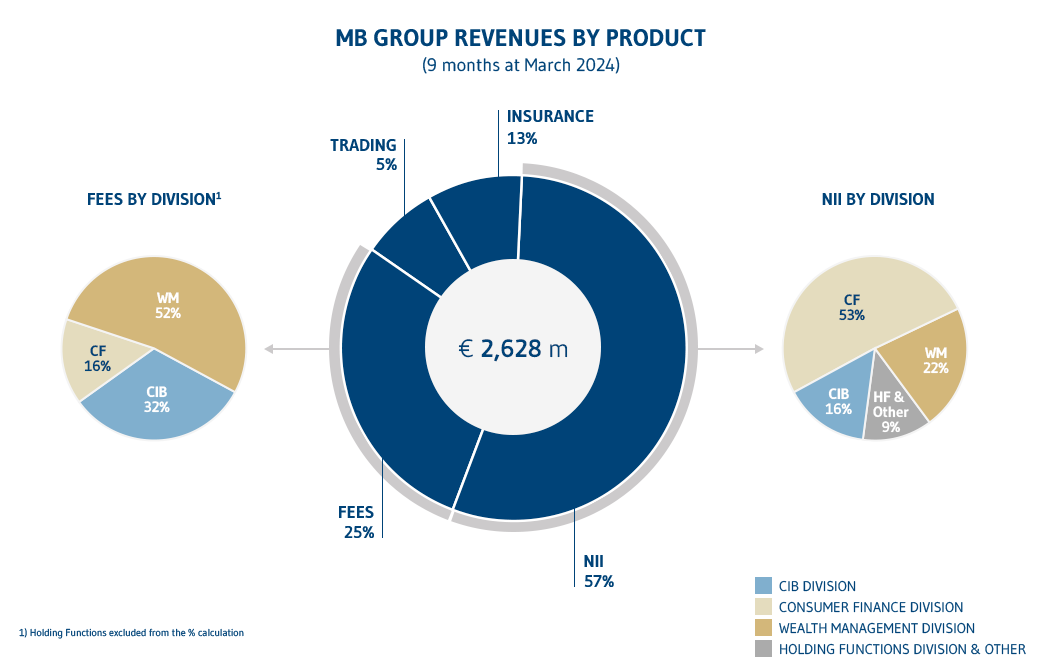

Revenues by division

Our structure is based on three complementary and synergic pillars: Asset Management and Private Banking, sectors in which we gradually established a foothold over the last few years and in which we intend to invest further, also through targeted acquisitions; the historical activity of Investment Banking (Corporate & Investment Banking), in which we have a leading position in Italy, with a deeply-rooted presence abroad; Consumer Banking activity, in which we have been pioneers in Italy ever since our foundation.

Our revenues are currently balanced between corporate/insurance (roughly 40%) and Retail/Private (around 60%) activities. Revenues from equity investments refer primarily to the 13% stake in Assicurazioni Generali (from valuation using the equity method).

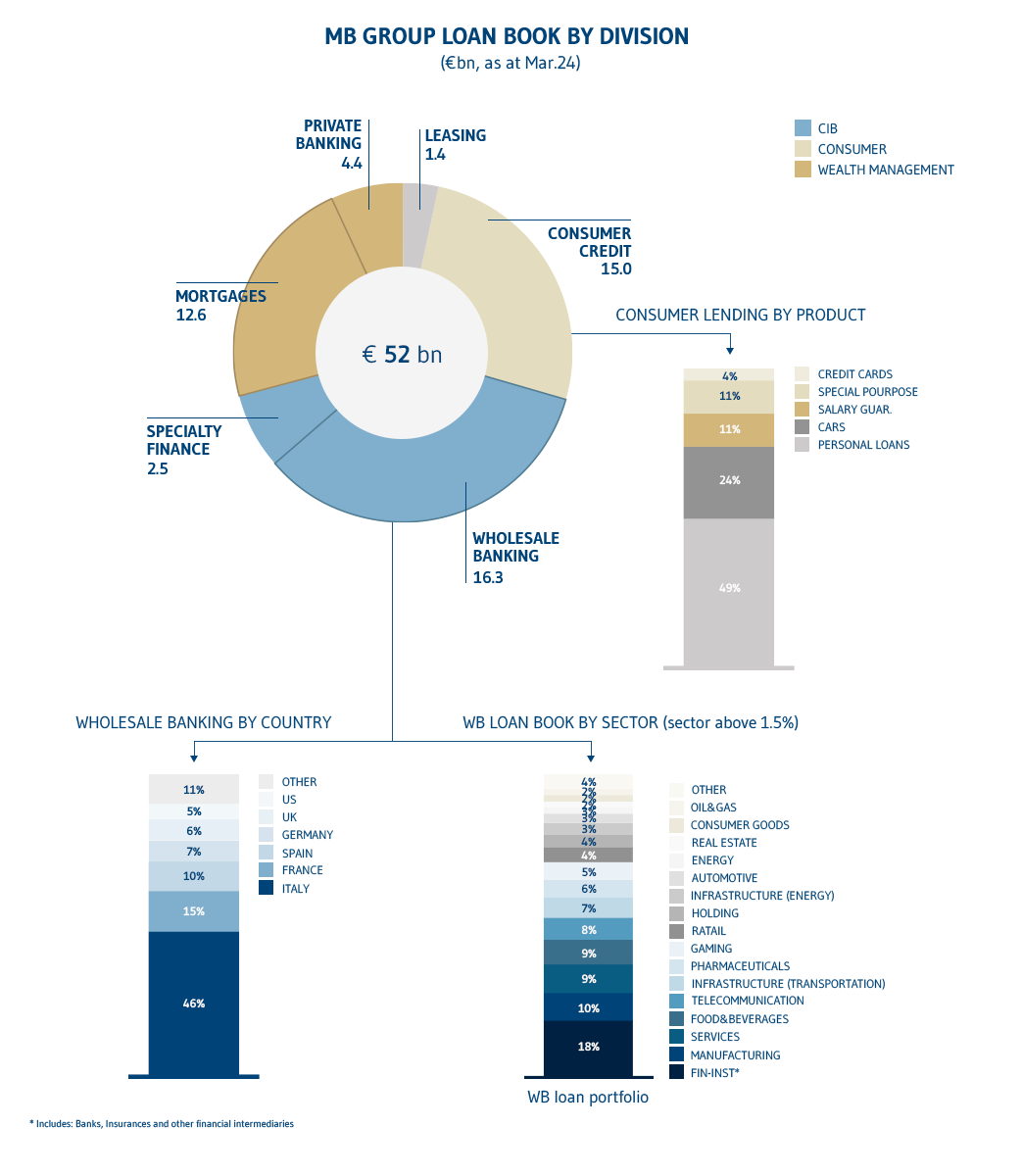

Loans by division

Over the last few years we have diversified our lending, to ensure a balance between corporate and retail.

Corporate loans:

- in Wholesale Banking, our group concentrates on large corporate, and around half of lending is carried out abroad;

- our portfolio is diversified by business sector and is increasingly less concentrated;

- we are not present in FICC activities (fixed income, currencies and commodities), in the process of global restructuring, and nor even in problematic segments/products such as small Italian companies, the shipping market and real estate development.

Retail loans:

- Consumer Banking accounts for roughly half of retail lending, with the remainder primarily residential mortgages;

- Consumer lending loan book is highly fragmented with a 24 month duration, personal loans rapresent more than half of the toal amount.

Assets managed

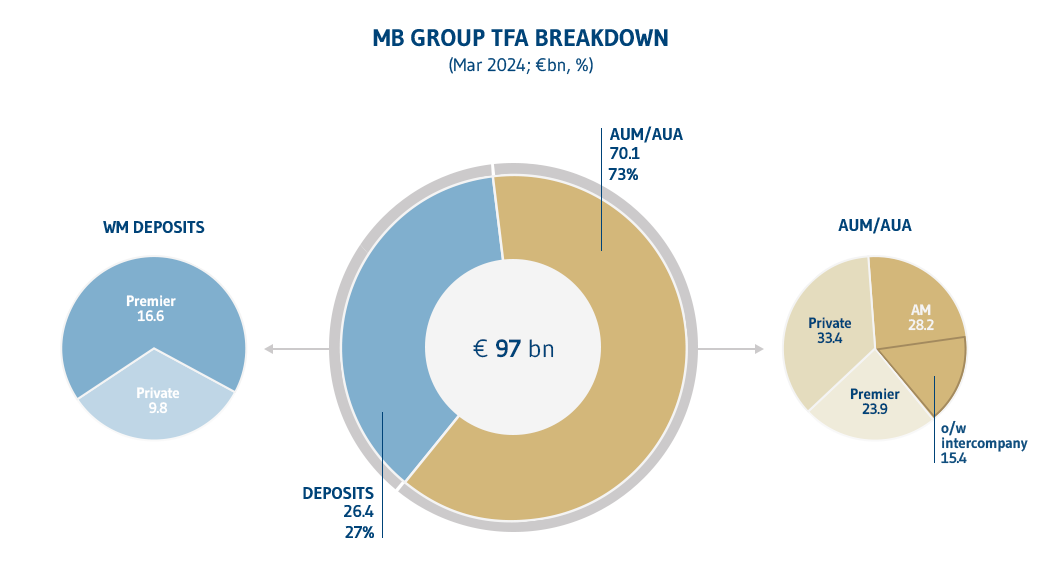

- TFA around €94bn as at Dec 2023

- AUM/AUA around 70% of TFA

- Wealth Management deposits at €27.7bn

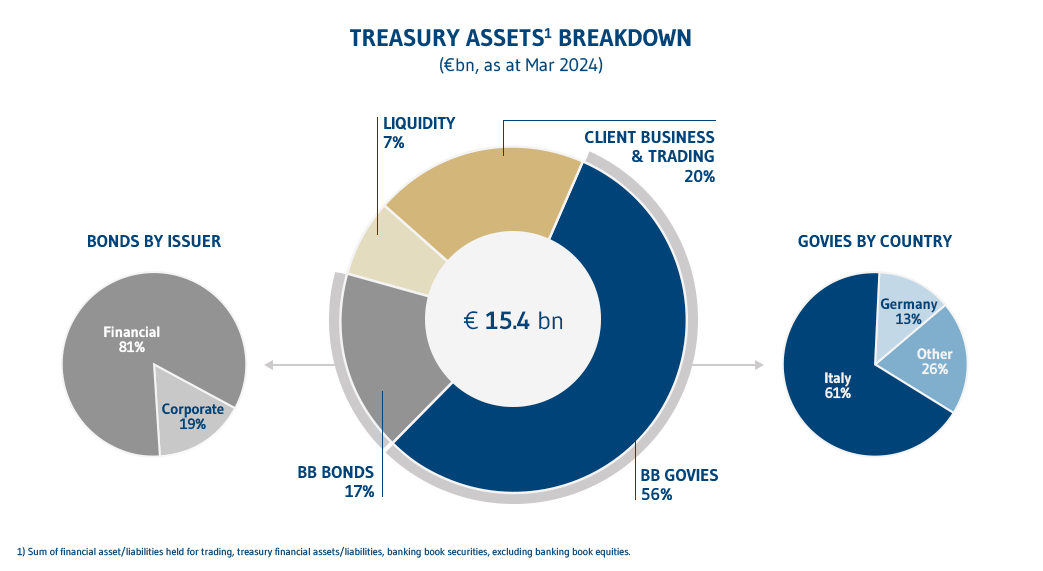

Securities portfolio

- Portfolio optimised by dimension and composition

- Prudent risk management based on the selection of high quality assets